Renter’s insurance options provide a crucial safety net for tenants, offering various choices for coverage and premiums. From standard plans to specialized options, the landscape is diverse and multifaceted. Let’s dive into the world of renter’s insurance to uncover the best choices for your needs.

Types of Renter’s Insurance: Renter’s Insurance Options

When it comes to renter’s insurance, there are a few different options available in the market to choose from based on your needs and budget. Let’s take a closer look at the types of renter’s insurance you can consider.

Standard Renter’s Insurance vs. Comprehensive Renter’s Insurance

Standard renter’s insurance typically covers the basics such as personal property, liability protection, and additional living expenses in case your rental becomes uninhabitable. On the other hand, comprehensive renter’s insurance offers a wider range of coverage, including protection for valuable items, electronics, and high-value possessions. While standard renter’s insurance is more affordable, comprehensive coverage provides greater peace of mind for those with valuable belongings.

Specialized Renter’s Insurance Options, Renter’s insurance options

For individuals with specific needs, there are specialized renter’s insurance options available. These specialized plans cater to those who own valuable jewelry, electronics, or high-end items that may not be fully covered under a standard policy. By opting for specialized renter’s insurance, you can ensure that your most prized possessions are protected in case of theft, damage, or loss.

Coverage Details

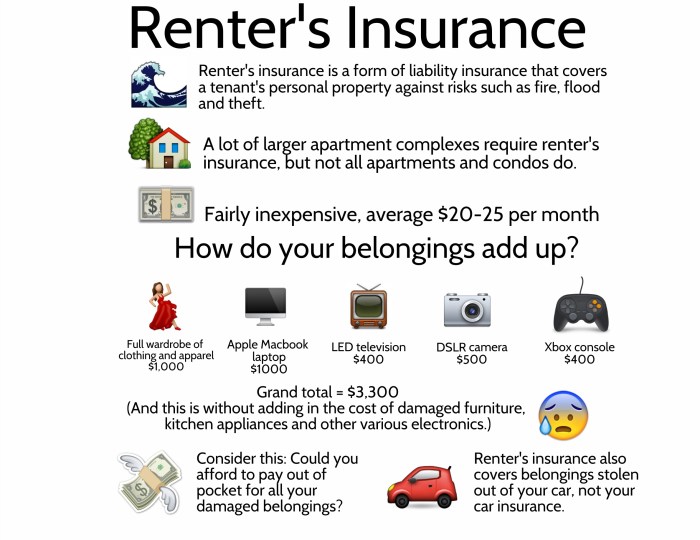

When it comes to renter’s insurance, understanding the coverage details is crucial for protecting your belongings and financial well-being. Let’s break down what a typical renter’s insurance policy covers and explore additional coverage options that can further safeguard you in case of unexpected events.

Standard Coverage

- Your personal belongings are typically covered under a standard renter’s insurance plan. This includes furniture, electronics, clothing, and other valuables in case of theft, fire, or other covered perils.

- Most policies also provide liability coverage, which protects you in case someone is injured in your rental unit and decides to sue you for damages. This coverage can help with legal fees and medical expenses.

- In addition, standard renter’s insurance often includes coverage for additional living expenses. If your rental becomes uninhabitable due to a covered event, such as a fire, your insurance can help cover the cost of temporary housing and other necessary expenses.

Additional Coverage Options

- Consider adding on valuable items coverage to protect high-ticket items like jewelry, art, or collectibles that may exceed the coverage limits of a standard policy.

- Flood insurance and earthquake insurance are typically not included in standard renter’s insurance, so you may want to purchase separate policies if you live in an area prone to these natural disasters.

- If you work from home, you may need to add a business property coverage rider to protect your work equipment and inventory.

- Pet liability coverage can also be added to your policy to protect you in case your pet causes injury or property damage to others.

Factors Influencing Premiums

When it comes to renters insurance, the cost of premiums can vary based on several key factors. Let’s dive into how location, coverage limits, deductible amounts, and personal factors can all impact the price you pay for renter’s insurance.

Location

The location of your rental property plays a significant role in determining your insurance premium. Areas prone to natural disasters or high crime rates may result in higher premiums compared to safer neighborhoods. For example, renting an apartment in a flood-prone area or a region with high burglary rates can lead to increased insurance costs.

Coverage Limits

The amount of coverage you select for your renters insurance policy directly affects the premium you pay. Opting for higher coverage limits to protect valuable belongings or add-ons like identity theft protection will result in higher premiums. On the other hand, choosing lower coverage limits can help reduce your insurance costs.

Deductible Amounts

The deductible is the amount you have to pay out of pocket before your insurance kicks in. Typically, choosing a higher deductible will lower your premium, as you are taking on more financial responsibility in the event of a claim. On the contrary, a lower deductible means higher premiums but less out-of-pocket expenses when filing a claim.

Personal Factors

Personal factors such as your age, credit score, and claims history can also impact your renters insurance premium. Younger individuals may face higher premiums, while those with a good credit score could receive discounts. Additionally, a history of frequent claims may lead to increased premiums due to a higher perceived risk.

Choosing the Right Policy

When it comes to selecting the right renter’s insurance policy, it’s essential to evaluate your individual needs and choose coverage that suits your specific situation. Here is a guide to help you navigate through the process and make an informed decision.

Evaluating Your Needs

- Assess the value of your belongings: Make an inventory of your personal items and determine their total worth to ensure you have adequate coverage.

- Consider your location: If you live in an area prone to natural disasters or theft, you may need additional coverage for such risks.

- Review your lease agreement: Check if your landlord requires a specific level of coverage and ensure your policy meets those requirements.

Comparing Policies

- Look at coverage limits: Compare the maximum coverage amount offered by different policies to see which one aligns with your needs.

- Check deductible amounts: Consider how much you are willing to pay out of pocket in case of a claim and choose a policy with a deductible you can afford.

- Review additional benefits: Some policies offer extra features like liability coverage or coverage for temporary living expenses – evaluate these to see if they are important to you.

Selecting the Right Policy

- Consider the overall cost: While price shouldn’t be the only factor, compare premiums from different insurers and choose a policy that offers good value for money.

- Read the fine print: Make sure you understand all the terms and conditions of the policy before making a decision to avoid any surprises in the future.

- Seek advice if needed: If you’re unsure about certain aspects of a policy, don’t hesitate to ask questions and seek clarification from the insurance provider.