Diving into the loan approval process, buckle up as we break down the ins and outs of getting that green light for your loan.

From the initial application to the final decision, we’ve got you covered with everything you need to know.

Loan Approval Process Overview

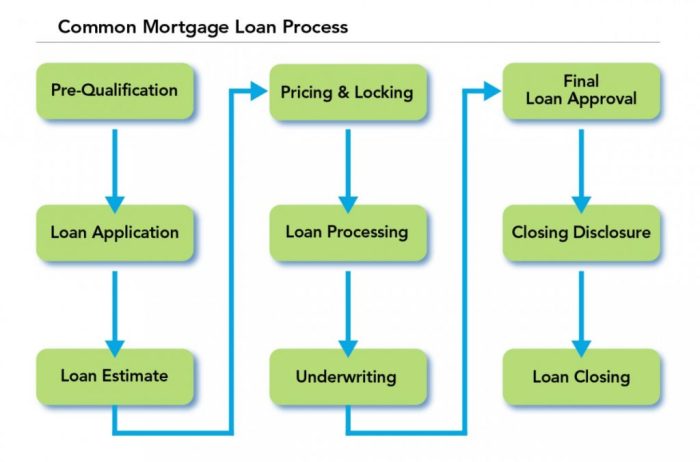

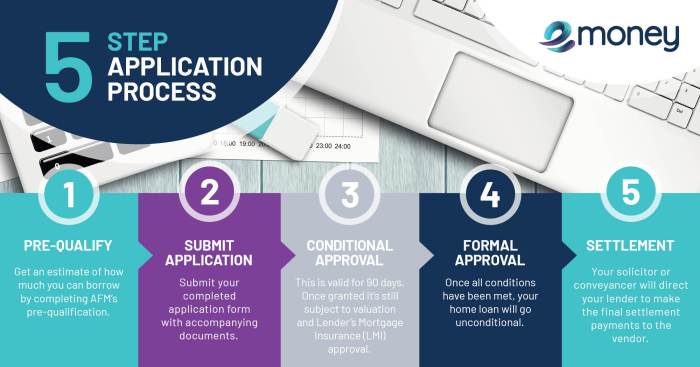

When it comes to getting approved for a loan, there are several key steps involved in the process. From submitting your application to receiving a final decision, it’s important to understand the timeline and parties involved.

General Steps

- 1. Application: The process starts with the borrower submitting a loan application, providing details about their financial situation and the purpose of the loan.

- 2. Review: The lender will review the application, assessing the borrower’s creditworthiness, income, and other relevant factors.

- 3. Underwriting: An underwriter will then analyze the borrower’s information to determine the level of risk involved in approving the loan.

- 4. Approval Decision: Based on the underwriter’s assessment, the lender will make a final decision on whether to approve the loan.

Key Parties

- Borrower: The individual or entity seeking the loan.

- Lender: The financial institution or lender providing the funds.

- Underwriter: The individual responsible for assessing the borrower’s risk profile and making recommendations for approval.

Timeline

The timeline for the loan approval process can vary depending on the complexity of the loan and the lender’s internal procedures. However, in general, it can take anywhere from a few days to several weeks to receive a final decision after submitting an application.

Required Documentation

To get your loan approved, you’ll need to gather some important documents to support your application. These documents help lenders assess your financial situation and determine if you’re a suitable candidate for a loan.

Common Documents

- Proof of income: This can include pay stubs, tax returns, or bank statements. Lenders need to see that you have a steady income to repay the loan.

- Identification: A driver’s license, passport, or other government-issued ID is required to verify your identity.

- Credit history: Lenders will check your credit report to evaluate your creditworthiness and determine the interest rate for your loan.

- Employment verification: You may need to provide proof of employment, such as a letter from your employer or recent pay stubs.

- Asset documentation: If you have assets like property or investments, you may need to provide documentation to show their value.

Comparison of Documentation Requirements

When it comes to different types of loans, the documentation requirements can vary. For example, mortgage loans typically require more extensive documentation compared to personal loans. Mortgage lenders may ask for additional documents such as property appraisals, homeowners insurance, and proof of down payment. Personal loans, on the other hand, may have simpler documentation requirements since they are typically smaller amounts and unsecured.

Credit Check and Analysis: Loan Approval Process

When applying for a loan, one of the crucial steps in the approval process is the credit check and analysis. Lenders use this information to assess the borrower’s creditworthiness and ability to repay the loan.

Importance of Credit Checks

A credit check provides lenders with valuable insights into an individual’s financial history and behavior. It helps them evaluate the risk associated with lending money to a particular borrower. By reviewing credit reports, lenders can determine whether the applicant has a history of making timely payments, managing debt responsibly, and maintaining a good credit score.

Credit Scores and Loan Approval Decisions

Credit scores play a significant role in loan approval decisions. A higher credit score indicates a lower credit risk for lenders, making it more likely for the borrower to secure a loan with favorable terms and interest rates. On the other hand, a low credit score may result in loan denial or higher interest rates to offset the perceived risk.

Factors Impacting Creditworthiness, Loan approval process

- Payment History: Timely payments on credit accounts demonstrate responsible financial behavior.

- Credit Utilization: Keeping credit card balances low relative to credit limits shows good money management.

- Length of Credit History: A longer credit history provides more data for lenders to assess borrower reliability.

- Types of Credit: A healthy mix of credit accounts, such as credit cards, loans, and mortgages, can positively impact credit scores.

- New Credit Applications: Multiple recent credit inquiries may signal financial distress and lower credit scores.

Underwriting Process

The underwriting process is a crucial step in the loan approval process where a financial professional, known as an underwriter, carefully assesses the borrower’s financial situation and the risk associated with providing a loan.

Role of an Underwriter

Underwriters play a vital role in analyzing loan applications to determine if the borrower meets the lender’s criteria for approval. They evaluate the borrower’s credit history, income, employment stability, and overall financial health to assess the level of risk involved in approving the loan.

- Underwriters review all required documentation provided by the borrower, such as pay stubs, tax returns, bank statements, and credit reports, to verify the information provided.

- They calculate the borrower’s debt-to-income ratio to assess their ability to repay the loan based on their current financial obligations.

- Underwriters also consider the type of loan being applied for, the loan amount, and the down payment to determine the overall risk of the loan.

Risk Evaluation and Loan Eligibility

Underwriters carefully evaluate the risk associated with each loan application to determine if the borrower is eligible for approval.

Underwriters look for red flags in the borrower’s financial history, such as late payments, high levels of debt, or a history of bankruptcy, which could indicate a higher risk of default.

Based on their analysis, underwriters make a decision on whether to approve, deny, or request additional information for the loan application. Their thorough evaluation helps protect lenders from potential losses and ensures that borrowers are financially capable of repaying the loan.

Conditional Approval vs. Final Approval

When it comes to the loan approval process, understanding the difference between conditional approval and final approval is crucial. Conditional approval means the lender has tentatively approved your loan application, but certain conditions must be met before the loan can be fully approved and funded. On the other hand, final approval signifies that all conditions have been satisfied, and the loan is ready to be disbursed.

Conditions for Final Approval

Before a loan can receive final approval, certain conditions typically need to be met. These conditions may vary depending on the type of loan and the lender, but some common examples include:

- Verification of employment and income: Lenders may require recent pay stubs or tax returns to confirm your financial stability.

- Appraisal of the property: For mortgage loans, the property being purchased may need to be appraised to ensure its value aligns with the loan amount.

- Debt-to-income ratio: Lenders often require a specific debt-to-income ratio to ensure you can comfortably repay the loan.

- Proof of insurance: Home and auto loans may require proof of insurance coverage to protect the lender’s investment.