Kicking off with the loan approval process, get ready to dive into the ins and outs of getting that financial green light. From understanding the steps involved to the key players in the game, this is your go-to guide for making those money moves.

Loan Approval Process Overview

When it comes to getting that green for your dreams, the loan approval process can feel like a maze. But fear not, I got your back with the lowdown on how it all goes down.

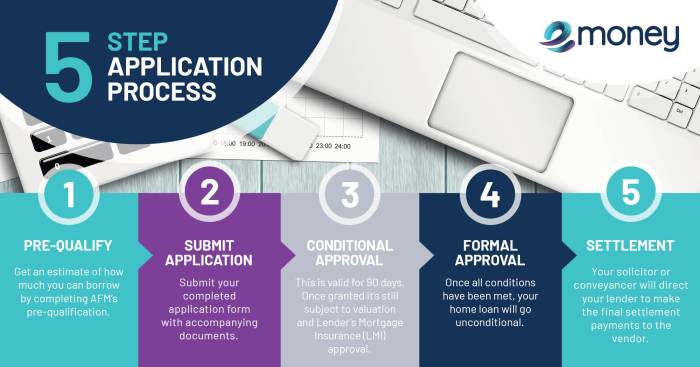

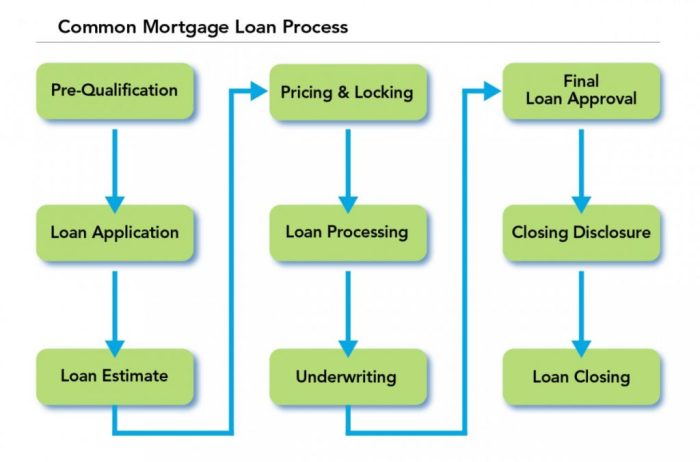

General Steps Involved

- 1. Application: You fill out the paperwork and spill the beans on your financial situation.

- 2. Verification: The lender checks your credit history, income, and other deets to see if you’re a good bet.

- 3. Underwriting: This is where the underwriter digs deep to assess the risk and decide if you’re worth the moolah.

- 4. Approval: If all checks out, you get the thumbs up and can start popping bottles (or maybe just celebrating quietly at home).

Key Parties Involved

- Borrower: That’s you, the one looking to borrow some cash to make things happen.

- Lender: The one with the money who decides if you’re a good investment.

- Underwriter: The detective who investigates your financial background and decides if you’re loan-worthy.

Importance of Credit History and Income Verification

Having a solid credit history and being able to show steady income are like gold stars on your loan application. They show the lender that you’re reliable and can pay back what you owe. So, keep those credit cards in check and those pay stubs handy!

Typical Timeline for Loan Approval

From the moment you submit your application to the final decision, the loan approval process can take anywhere from a few days to a few weeks. It all depends on how quickly you provide the necessary documentation and how efficient the lender is in processing your application.

Documentation Required

When applying for a loan, you will need to gather various documents to prove your financial stability and ability to repay the loan. These documents play a crucial role in the approval process, as they help lenders assess your creditworthiness and risk level.

Common Documents Needed

- Pay Stubs: These show your current income and employment status.

- Bank Statements: Provide a snapshot of your financial health and spending habits.

- Tax Returns: Show your income over the past few years.

Significance of Each Document

- Pay Stubs: Demonstrate your ability to generate income to repay the loan.

- Bank Statements: Show your financial stability and history of managing money.

- Tax Returns: Confirm your reported income and help lenders verify your financial status.

Tips for Organizing and Preparing Documents

- Keep all documents organized in a folder or digital file for easy access.

- Make copies of all documents in case they are requested by multiple parties.

- Double-check that all information is accurate and up to date before submitting.

Additional Documents for Specific Loans

For mortgage loans:

- Property Appraisal: Determines the value of the property being financed.

- Home Insurance: Protects the property and lender in case of damage or loss.

For personal loans:

- Proof of Identity: Such as a driver’s license or passport.

- Credit Score: Helps lenders assess your creditworthiness.

For auto loans:

- Vehicle Registration: Confirms ownership of the vehicle being financed.

- Purchase Agreement: Artikels the terms of the vehicle purchase.

Credit Score Evaluation

When it comes to the loan approval process, one crucial factor that lenders consider is the borrower’s credit score. Your credit score plays a significant role in determining whether you qualify for a loan and the terms you may be offered.

Impact of Credit Scores on Loan Approval

Your credit score is a reflection of your creditworthiness and financial responsibility. Lenders use this score to assess the risk of lending you money. A higher credit score indicates a lower risk for the lender, making you a more attractive borrower. On the other hand, a lower credit score may lead to higher interest rates or even rejection of your loan application.

Credit Score Ranges Accepted by Lenders

Lenders typically consider credit scores within a specific range. While the exact ranges may vary between lenders, a common breakdown is as follows:

– Excellent: 800-850

– Very Good: 740-799

– Good: 670-739

– Fair: 580-669

– Poor: Below 580

Strategies for Improving Credit Scores

If you have a lower credit score and want to increase your chances of loan approval, consider the following strategies:

– Paying bills on time

– Keeping credit card balances low

– Avoiding opening multiple new accounts

– Checking your credit report regularly for errors

Lenders’ Use of Credit Scores

Lenders use credit scores to gauge your risk profile and determine the likelihood of you repaying the loan. A higher credit score indicates a lower risk, while a lower credit score suggests a higher risk. This information helps lenders make informed decisions about loan approval and setting interest rates.

Underwriting Process

When it comes to the loan approval process, underwriters play a crucial role in determining whether a borrower qualifies for a loan. Underwriters are responsible for assessing the risk associated with lending money to an individual or a business. They carefully review all the documentation provided by the borrower and analyze their financial situation to make an informed decision.

Role of Underwriters

Underwriters consider various factors when evaluating a loan application. These include the borrower’s credit score, income, employment history, debt-to-income ratio, and the purpose of the loan. They also assess the property or asset being used as collateral, if applicable. By evaluating these criteria, underwriters can assess the borrower’s ability to repay the loan and the overall risk associated with the loan.

Reasons for Loan Application Denial

There are several common reasons why a loan application may be denied during the underwriting process. These include a low credit score, insufficient income, unstable employment history, high debt-to-income ratio, inadequate collateral, or incomplete documentation. It’s essential for borrowers to address these factors before applying for a loan to increase their chances of approval.

Navigating the Underwriting Process, Loan approval process

To navigate the underwriting process successfully, borrowers should ensure they have a good credit score, stable income, and a low debt-to-income ratio. It’s also crucial to provide all the necessary documentation and be transparent about your financial situation. Working with a knowledgeable loan officer can help borrowers understand the underwriting criteria and improve their chances of approval.